Property Investment

We’ll make Property Investment a simple process for you

Why Invest?

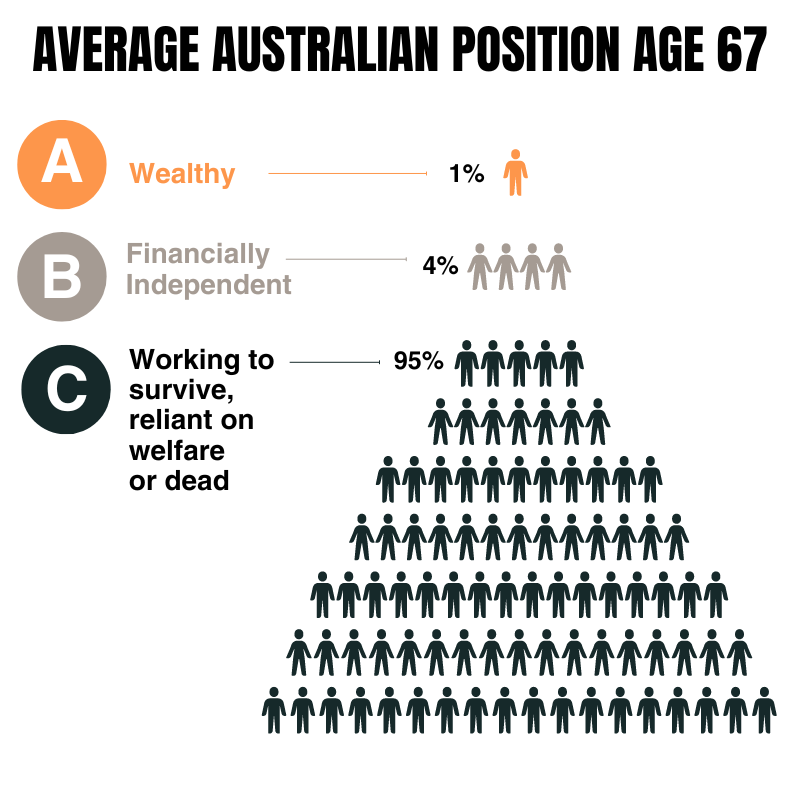

The below statistics of the average Australian position at age 67 are truly alarming.

Why Residential Property?

Residential property underpins Australia’s wealth. In fact, as an asset class, the value of Residential Real Estate is more than Australian Superannuation, Australian Listed Stocks & Commercial Real Estate combined.

The FACTS: Well located residential property in Australia roughly doubles every 7-10 years over the long term

The allure of property investment remains robust in Australia, underscored by recent data that highlights the significant role real estate plays in the nation’s economy and in individual investment portfolios. With the number of residential dwellings booming and market values seeing impressive increases, the sector not only serves as a cornerstone of Australian wealth but also presents a dynamic opportunity for investors.

As of January 2024, Australia is home to approximately 11.1 million residential properties. This impressive figure reflects the strong demand for housing in a nation celebrated for its vibrant cities and breath taking landscapes. The total value of Australia’s residential market has surged to an astounding $10.4 trillion, showcasing a thriving environment for property investments, despite the $2.3 trillion in outstanding mortgage debt. Remarkably, over 56.% of Australian household wealth is invested in housing, emphasising the crucial role of real estate not only as a home but as a pivotal investment vehicle that enhances the financial stability of millions.

Recent statistics from the Australian Taxation Office for the fiscal year 2020-21 reveal that around 2,245,500 Australians, constituting around 20% of the nation’s taxpayers, own an investment property. This represents approximately 3.25 million properties, affirming a strong commitment to real estate as a key tool for wealth generation. The distribution among investors indicates a preference for starting with a modest portfolio, as just over 71.00% own just one property. However, the ambitious few who own six or more properties demonstrate the potential to build substantial real estate portfolios.

Opportunities for New Investors:

These figures are not merely statistics; they narrate the ongoing success story of the Australian dream and offer a pragmatic roadmap for property investment. For those contemplating a venture into property investment, the current market conditions present both promising opportunities and challenges. The high market valuation indicates potential for capital gains, while the significant share of national wealth tied to real estate underscores its reputation as a secure investment avenue. Nevertheless, the substantial mortgage debt highlights the importance of strategic financial planning and risk management.

Invest Realty Australia has compiled this data and analysis to guide both seasoned and aspiring investors. If you’re considering an investment in residential property, we understand the dynamics of the Australian real estate market and are committed to helping clients navigate this complex yet rewarding field. Right now, is an opportune moment to explore how you can grow your wealth through strategic property investments.

Reach out to us at Invest Realty Australia and let us help you navigate your investment journey towards achieving better financial outcomes. Contact Us to book your free consultation today.